Try it for free

Real Time data

₹ 0.40 per GST ID

No charge you for wrong ID's

No expiry date on the prepaid wallet

Start with simply ₹1000+18%GST

Get results instantly with all required fields

16 required field

Free for everyone! No sign up!

Validate signed JSON using this tool

Decrypts JSON

Realtime data

Free for everyone!

No sign up!

Instant deletion of data on GSTN (including auto flown records)

Deletion across categories - B2B,EXP,CDNR,HSN

Free single GSTIN checks across Financial Years

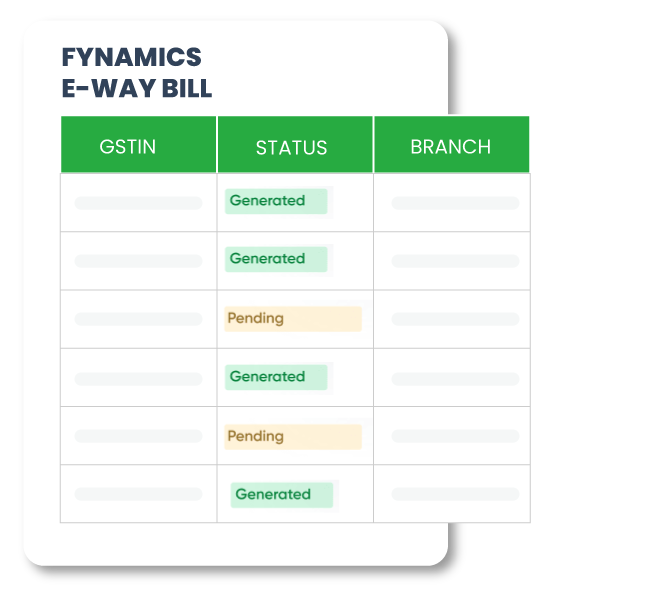

Filing status of any GST ID in seconds!

Download results in excel format for easy analysis

Individual and bulk check of multiple GSTINs and across multiple return periods

Can integrate with your ERP system for real-time check via APIs

Pricing based only on number of checks